The emergence of online comparison websites has revolutionized the car insurance market, empowering consumers to shop for the best car insurance rates with unprecedented ease. While these platforms offer a convenient way to compare quotes from multiple insurers, it’s crucial to understand that the lowest price isn’t always the best deal. Factors like coverage limits, deductibles, and discounts must be carefully considered to ensure you’re getting the right protection at a price that suits your budget.

Toc

In this comprehensive guide, we will explore the best car insurance rates available for new drivers, breaking down the essential elements you need to know to navigate this often complex landscape.

Understanding the Factors Influencing Car Insurance Rates for New Drivers

Navigating the world of car insurance can be overwhelming for new drivers, especially with the complexities of premiums and coverage. However, by understanding the key factors that impact your premiums, you can make informed decisions and potentially secure the best car insurance rates.

Driving Record

Your driving record is one of the most significant factors in determining your car insurance rates. A clean driving history with no tickets or accidents can lead to lower premiums, while a record of violations or at-fault accidents can significantly increase your costs. For example, in some states, a single speeding ticket can increase your premium by 20% or more. Additionally, if you are found at fault in an accident, your rates will likely increase significantly. The severity of the accident and the resulting damage can also impact your premium increase. Insurance companies often see new drivers as higher risk due to their lack of experience, which can result in higher premiums.

To improve your driving record, consider taking a defensive driving course, which can not only enhance your driving skills but also potentially earn you a discount on your insurance premium. Many insurers offer incentives for completing such courses, recognizing that it can lead to safer driving behaviors.

Age and Experience

Insurance companies view new drivers as higher-risk because they are more likely to be involved in accidents. As a result, younger drivers typically pay higher car insurance rates. According to industry statistics, new drivers can expect to pay premiums that are 2-3 times higher than those of experienced drivers.

However, as you gain more driving experience over time, your premiums may gradually decrease. Maintaining a clean driving record during this period is crucial for securing the best car insurance rates.

Vehicle Type and Safety Features

The type of vehicle you drive can also significantly affect your insurance rates. Newer vehicles equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and multiple airbags, often qualify for lower premiums. For instance, a 2023 Honda Civic with advanced safety features like lane departure warning and automatic emergency braking might qualify for a lower premium than a 2010 Toyota Corolla without such features. The newer vehicle’s safety features demonstrate a reduced risk of accidents and potentially lower repair costs, leading to lower insurance rates.

Conversely, high-performance or luxury vehicles tend to attract higher insurance costs due to their increased likelihood of theft and higher repair costs. When selecting a vehicle, consider how its safety features and overall risk profile will impact your insurance rates.

Location

Your geographical location plays a crucial role in determining your car insurance rates. Factors such as traffic density, accident rates, and crime rates in your area can all impact the premiums you’ll pay. Typically, urban areas with higher traffic congestion and accident rates have higher insurance costs compared to rural areas.

However, it’s important to note that some insurance companies may offer discounts for living in areas with lower crime rates or accident statistics, even if the location is considered urban. It’s always best to compare quotes from multiple insurers to see how your specific location impacts your rates. For instance, if you live in a city with a high incidence of auto theft or accidents, you may face higher premiums. On the other hand, if you’re located in a quieter suburban or rural area, your rates may be lower. It’s essential to consider how your living situation affects your insurance costs.

Credit Score

In some states, insurance companies may use your credit score as a factor in determining your car insurance rates. A good credit score can lead to lower premiums, as insurers often view individuals with better credit histories as more responsible and less likely to file claims.

Maintaining a healthy credit history can benefit your insurance costs. If your credit score is less than stellar, consider taking steps to improve it before shopping for insurance. Paying down debt, making payments on time, and avoiding new credit inquiries can help boost your score over time.

Strategies for Finding the Best Car Insurance Rates as a New Driver

Now that you understand the key factors influencing your car insurance rates, let’s explore practical strategies to help you find the most competitive coverage.

Compare Quotes from Multiple Insurers

One of the best ways to find the best car insurance rates is to compare quotes from multiple insurance providers. Utilizing online comparison websites or reaching out to agents directly can help you quickly and easily see different options side-by-side.

When comparing quotes, pay attention not just to the price but also to the coverage limits and deductibles. Sometimes, a slightly higher premium might offer more comprehensive coverage, which could save you money in the long run if you have an accident.

Take Advantage of Discounts and Bundling Options

As a new driver, you may be eligible for various discounts that can help lower your car insurance costs. These can include:

- Good Student Discounts: Many insurers offer discounts to students who maintain a B average or higher.

- Safe Driver Discounts: Completing a defensive driving course or maintaining a clean driving record can qualify you for discounts.

- Multi-Car Discounts: If you insure multiple vehicles with the same provider, you may receive a discount.

Additionally, bundling your car insurance with other policies, such as homeowner’s or renter’s insurance, can often lead to significant savings. Insurance companies frequently provide discounts for customers who choose to consolidate their coverage under one provider.

Bài viết liên quan:

- https://tuyensinhhuongnghiep.edu.vn/the-best-car-insurance-in-washington-state-for-young-drivers-securing-affordable-coverage/

- https://tuyensinhhuongnghiep.edu.vn/best-affordable-car-insurance-for-young-drivers-in-texas-find-cheap-coverage-in-2024/

- https://tuyensinhhuongnghiep.edu.vn/finding-the-best-car-accident-attorney-in-san-francisco-your-guide-to-getting-the-compensation-you-deserve/

- https://tuyensinhhuongnghiep.edu.vn/finding-the-best-car-wreck-attorney-in-new-orleans-navigating-the-legal-landscape/

- https://tuyensinhhuongnghiep.edu.vn/the-best-lawyer-for-car-accident-in-houston-a-comprehensive-guide/

Negotiate Your Rate

Don’t be afraid to negotiate with insurers for a better rate, especially if you have a clean driving record, good credit, or are bundling policies. Be prepared to discuss your qualifications and demonstrate why you deserve a lower premium.

Insurance agents often have some flexibility in pricing, especially if you can provide evidence of your good driving habits or other discounts you may qualify for.

Telematics: A New Trend in Car Insurance

Telematics is a technology that uses sensors and data to track driving habits. Insurance companies are increasingly offering discounts to new drivers who agree to use telematics devices or apps. These devices monitor driving behaviors like speed, acceleration, braking, and time of day. Drivers with good driving habits can earn discounts and even personalized feedback on their driving. For example, the Progressive Snapshot program allows new drivers to earn discounts by driving safely and recording their driving habits using a small device plugged into their car.

Many insurers also offer usage-based insurance programs, where your premium is based on your actual driving habits, further benefiting new drivers who drive less frequently or in safer conditions.

Tips for Saving Money on Car Insurance as a New Driver

In addition to comparing quotes and taking advantage of discounts, there are several other steps you can take to reduce your car insurance costs as a new driver.

Maintain a Clean Driving Record

Maintaining a clean driving record is one of the most effective ways to keep your car insurance rates low. Traffic violations like speeding tickets, reckless driving, or accidents can significantly increase your premiums. To ensure your record stays clean, practice safe driving habits at all times. Always adhere to speed limits, use seat belts, avoid distractions like mobile phones, and stay alert to changing traffic conditions. If you do receive a ticket, attending a traffic school may help remove the infraction from your record, depending on your state’s laws. By demonstrating responsibility behind the wheel, you not only enhance your personal safety but also position yourself for lower insurance costs.

Choose the Right Vehicle

As a new driver, choosing the right vehicle can significantly impact your insurance rates. Generally, cars that are considered safer, less expensive to repair, and less likely to be stolen tend to have lower insurance premiums. When selecting a car, consider models with high safety ratings, as insurers often look favorably upon vehicles equipped with advanced safety features like airbags, anti-lock brakes, and electronic stability control. Additionally, opting for a used car instead of a brand-new model can also result in lower insurance costs due to the decreased replacement value. By carefully selecting a vehicle that aligns with these criteria, you can further reduce your insurance expenses while ensuring a safe driving experience.

Consider Increasing Your Deductible

Another effective strategy to lower your car insurance premium as a new driver is to consider increasing your deductible. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Typically, policies with higher deductibles have lower monthly or annual premiums. However, it’s crucial to ensure that the deductible is affordable and within your financial reach in the event of an accident. Carefully assess your financial situation and choose a deductible amount that provides a balance between manageable out-of-pocket expenses and affordable premiums.

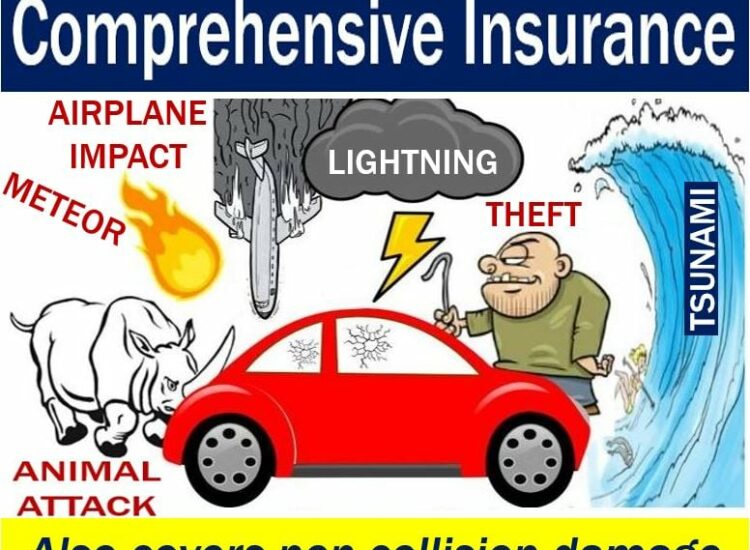

Limiting Coverage on Older Vehicles

For new drivers with older vehicles, limiting certain types of coverage could result in cost savings. Comprehensive and collision coverage may not be cost-effective for cars that are significantly depreciated in value. Consider the age, condition, and market value of your vehicle when deciding on the extent of coverage. In some cases, the cost of repairs may exceed the value of the car itself, making these coverage types less practical. Evaluate the trade-off between potential savings and risk to determine the most suitable coverage approach for your specific situation.

Frequently Asked Questions

Q: What is the minimum car insurance coverage required for new drivers in California?

A: In California, the minimum required car insurance coverage for new drivers includes:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident

- Property Damage Liability: $5,000 per accident

- Uninsured Motorist Coverage: $15,000 per person and $30,000 per accident

Q: How can I get a discount on my car insurance as a new driver?

A: As a new driver, you may be eligible for various discounts, such as:

- Good student discount: Maintain a B+ average or higher to qualify.

- Safe driver discount: Complete a defensive driving course to demonstrate your safe driving skills.

- Multi-car discount: Insure multiple vehicles with the same insurance provider.

Q: What is the best way to compare car insurance quotes?

A: The best way to compare car insurance quotes is to use online comparison websites or contact insurance agents directly. This allows you to see personalized quotes from multiple insurers side-by-side, helping you find the most competitive rates.

Q: How can I lower my car insurance costs as a new driver?

A: In addition to comparing quotes and taking advantage of discounts, there are several other ways to lower your car insurance costs as a new driver:

- Maintain a clean driving record by avoiding violations and accidents.

- Choose a vehicle with good safety ratings and advanced features.

- Increase your deductible, but make sure you can afford the higher out-of-pocket costs.

Conclusion

In conclusion, as a new driver, taking proactive steps to manage your car insurance costs can yield significant savings. By maintaining a clean driving record, selecting the right vehicle, and considering strategic options like adjusting your deductible or limiting coverage on older vehicles, you can control your expenses while still ensuring adequate protection. It’s also important to regularly review your policy and compare quotes to stay informed about the best deals available. Adopting these practices not only aids in financial savings but also promotes responsible driving habits, contributing to a safer driving community.